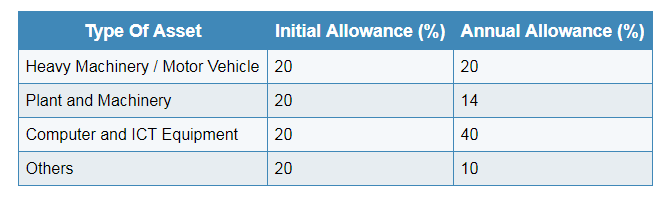

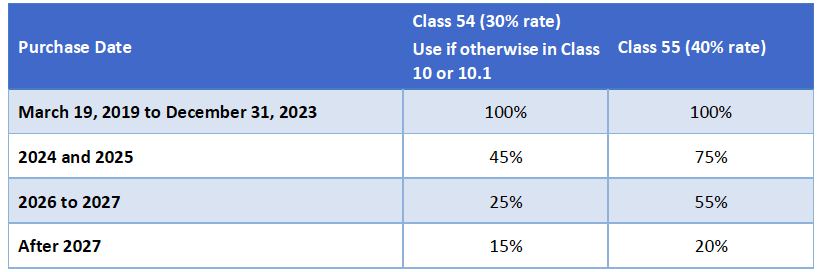

Here are some other commonly claimed Capital Cost Allowance Classes along with their respective depreciation rates. Motor vehicle allowance paid on a per kilometre basis Section 22 of the Fringe Benefits Tax Assessment Act 1986 the FBT Act generally exempts an expense payment benefit if it is a reimbursement of car expenses of a car owned or leased by an employee that is calculated by reference to the distance travelled by the car ie.

1975 Leyland Australia Jaguar Xj6 Xj V12 Aussie Original Magazine Advertisement Jaguar Car Jaguar Jaguar Xj12

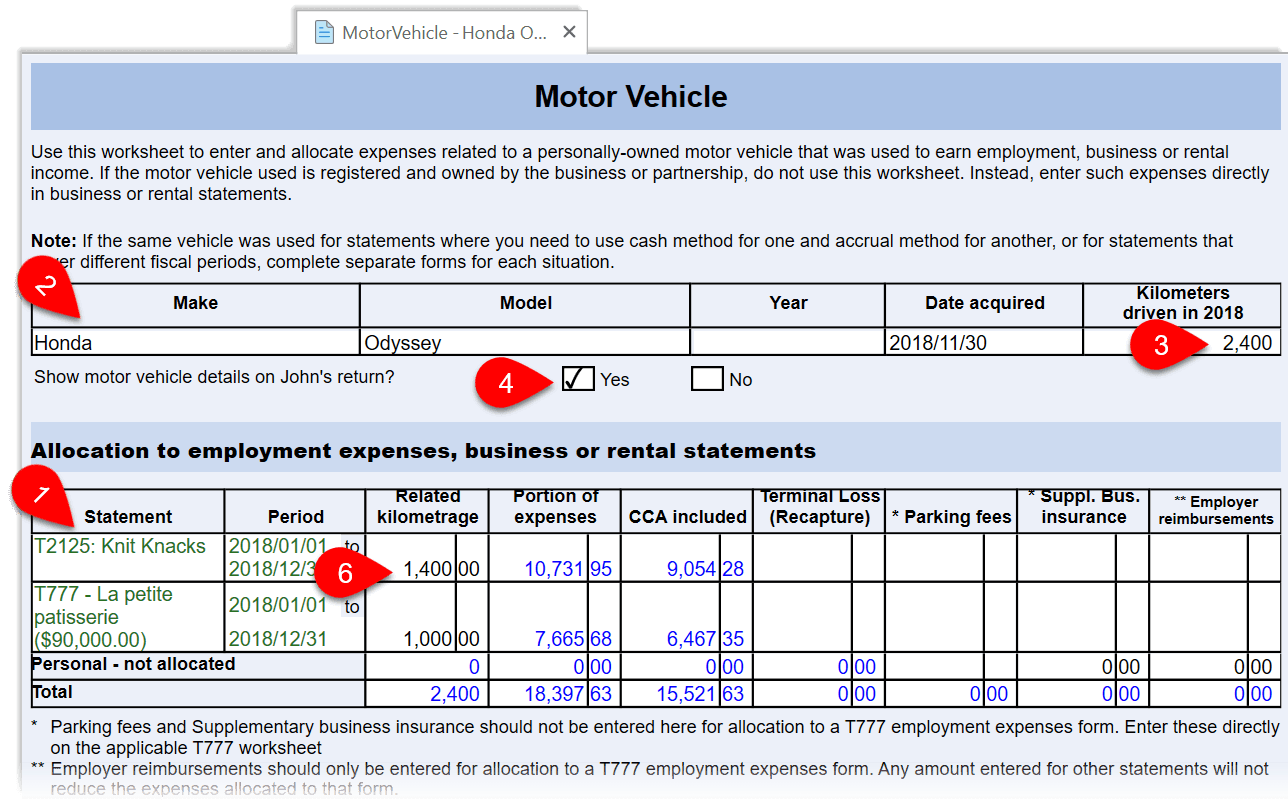

Your employee can claim a deduction for costs related to the business use of their vehicle in their own tax return minus any reimbursements they.

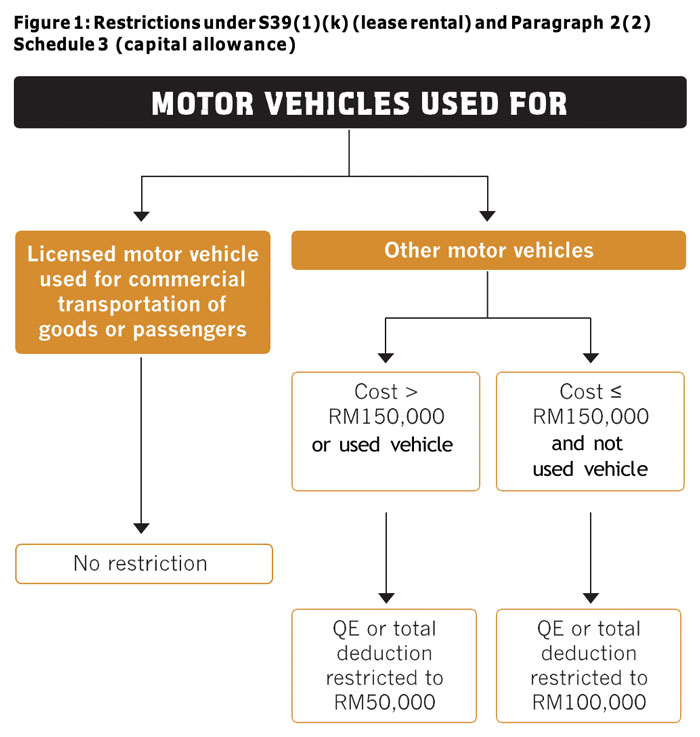

. For the purposes of this entry the specification of the motor vehicle shall be determined as per the Motor Vehicles Act 1988 59 of 1988 and the rules made there under. She enters this amount in column 3 of Area B. A non-commercial vehicle is a vehicle that is not used for commercial purpose such as car and multi-purpose vehicle for private use.

These allowances include allowance granted in order to meet the travelling cost on transfer or on tour allowance granted to meet the daily charges incurred by the employee on account of absence from the normal place of duty and allowances provided to meet the conveyance expenditure in performance of duty only if the employer does not provide free conveyance to. Old and used diesel driven motor vehicles of engine capacity of 1500 cc or more and of length of 4000 mm Explanation. To calculate CCA list all the additional depreciable property your business has bought this year.

Class 14 Class 1 includes most buildings acquired after 1987 though buildings can also fall under Class 3 5 or Class 6 10 depending upon various factors such as the type of construction and the buildings purpose. Trade and Business Licence. Your assets cost base what you paid for it your capital proceeds the amount you receive.

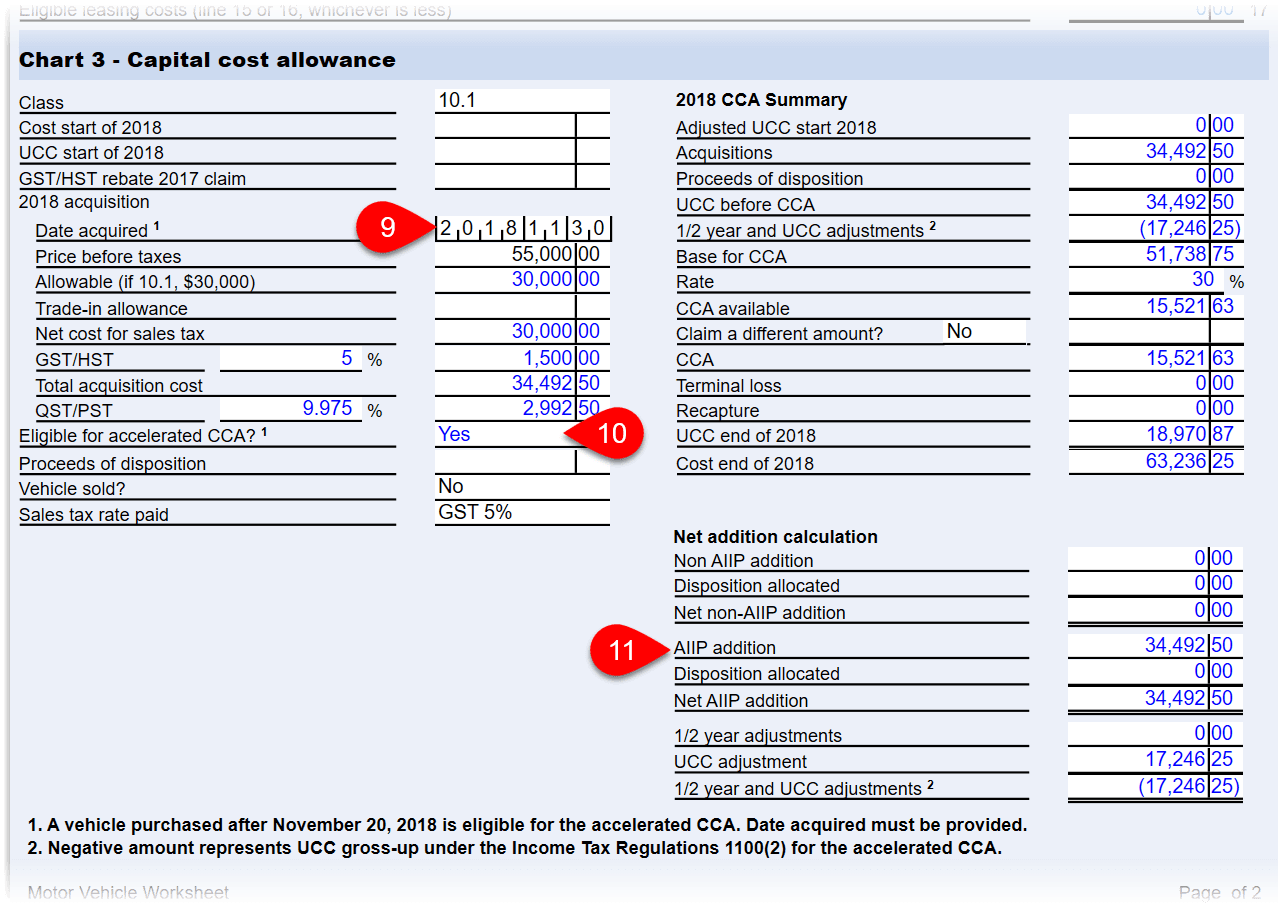

The Leave Travel Allowance exemption is available for two children only who are born after October 1 1998. No Export and Import HSN Codes Prescribed. Therefore Viviennes capital cost is 33900 30000 1500 2400.

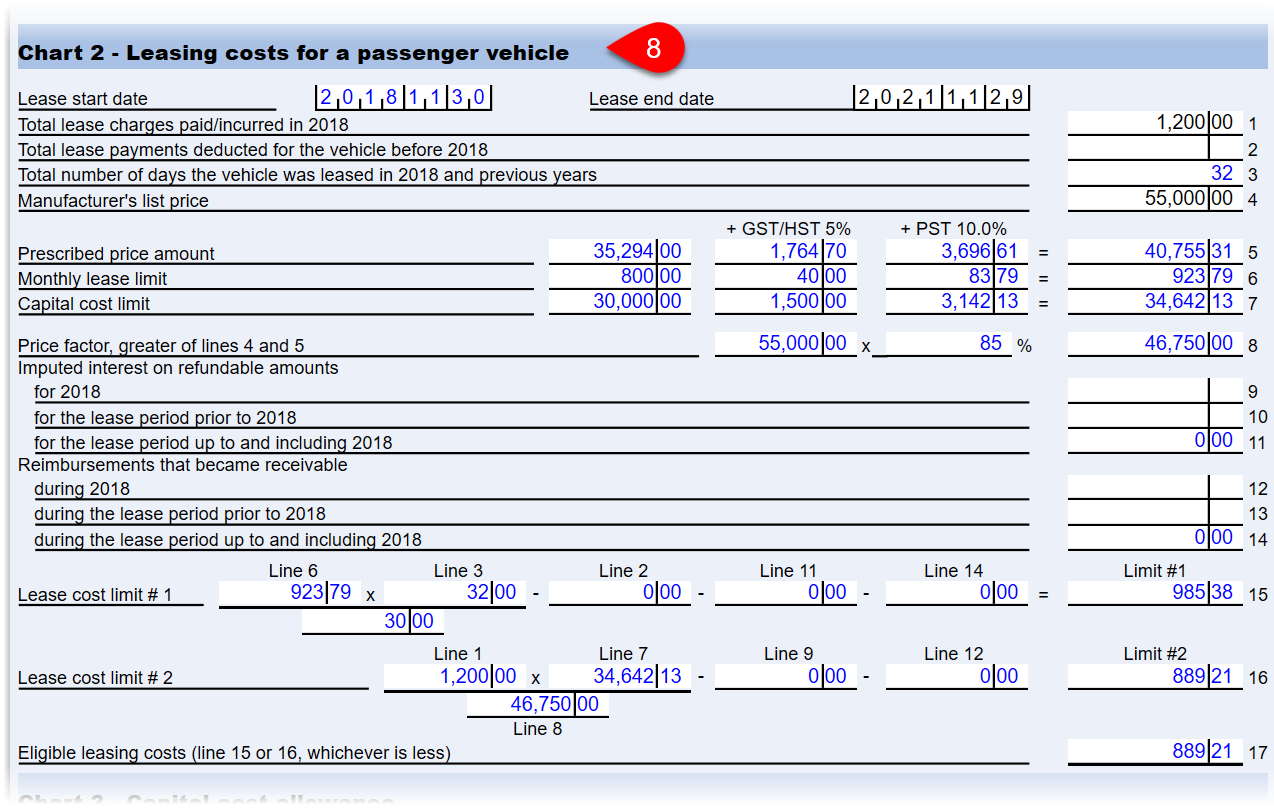

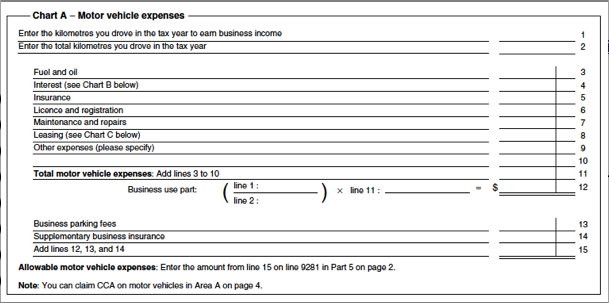

Note that goods and services tax GST and provincial sales tax PST or harmonized sales tax HST should not be included when calculating the cost of a vehicle to. Examples are compressors elevators. Motor vehicle allowance or reimburse them their costs your business can claim a deduction for the allowance or expenses reimbursed such as the cost of fuel.

Skip to content. You must declare the amount of any capital gain or capital loss you make when you dispose of a capital asset such as an investment property shares or crypto assets. Vivienne puts vehicle 2 into Class 10 since she bought it in 2021 and it did not cost her more than 30000.

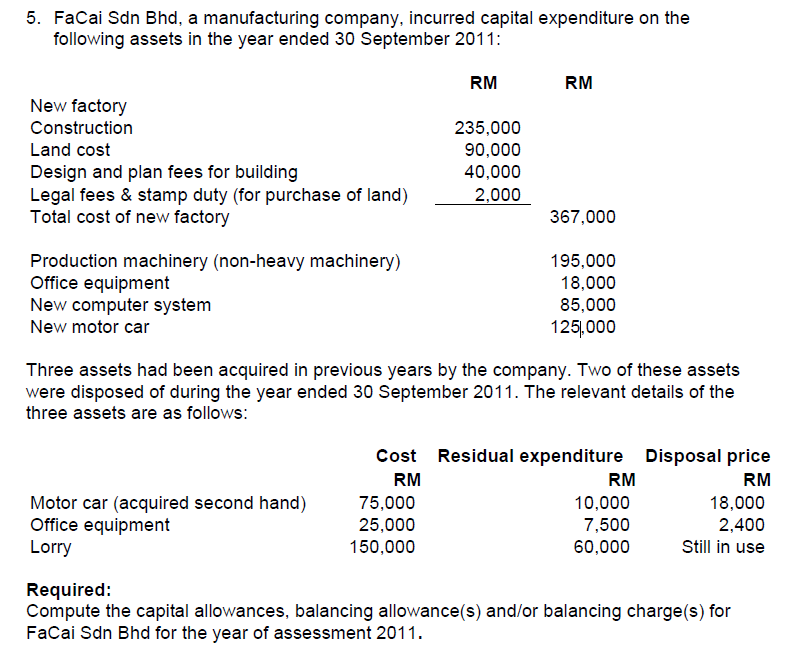

Assets Purchased for Use by Subcontractors and Other Parties. Term Insurance for Housewife. 53 Category of plant and machinery General plant and machinery does not fall under the category of heavy machinery and motor vehicle.

11132019 04142018 by Amit Bansal. Car allowance income tax liability depends on the purpose of uses of the vehicle. Stamp Duty and Transfer Tax.

If you have received a non-taxable motor vehicle allowance and can show that the employment-related motor vehicle expenses are in excess of the allowance and voluntarily include the amount of the allowance in income you can deduct your motor vehicle expenses if. In a block of four years one can claim LTA for two times only. Financial Control How to make Personal Finance under Control Menu.

Motor vehicle allowance paid on a per kilometre basis Section 22 of the Fringe Benefits Tax Assessment Act 1986 Cth the FBT Act generally exempts an expense payment benefit if it reimburses an employee for car expenses of a car they own or lease and the reimbursement is calculated by reference to the distance travelled by the car ie. Your company may also claim capital allowances on the costs of plant and machinery used by its subcontractors in outsourcing arrangements. Generally your capital gain or capital loss is the difference between.

When you look at Area ASchedule 8 you will see a table with eight different columns and a separate chart for Motor vehicle CCA. S-plated private passenger car Water and gas pipings Refer to Section 14N deduction for the tax treatment of such renovation costs. Viviennes capital cost is 31640 28000 1400 2240.

Eligible interest you paid on a loan used to buy the motor vehicle. If one has not claimed LTA in a particular block year then it can be carried to the next block year and can be used in the 1 st year of the next block only. She enters this amount in column 3 of Area B.

Renew vehicle insurance online from PolicyBazaar to get the best comprehensive policy for a car bike and commercial vehicles from various motor insurance companies in India. Media Room TAJ In The News. Any vehicle not classed as a motor vehicle The Canada Revenue Agency provides a chart of vehicle definitions for vehicles bought or leased after June 17 1987 and used to earn business income.

Paid on a cents per kilometre. Nevertheless starting from year of assessment 2001 the limitation amount for qualifying plant expenditure for motor vehicle other than a motor vehicle licensed by the appropriate authority for commercial transportation of goods or passengers which is bought on or after 28102000 has been increased from RM50000 to RM100000 on condition that the motor vehicle bought is a. You cant claim depreciation if the vehicle is owned by your employee.

Car Allowance Exemption us 10.

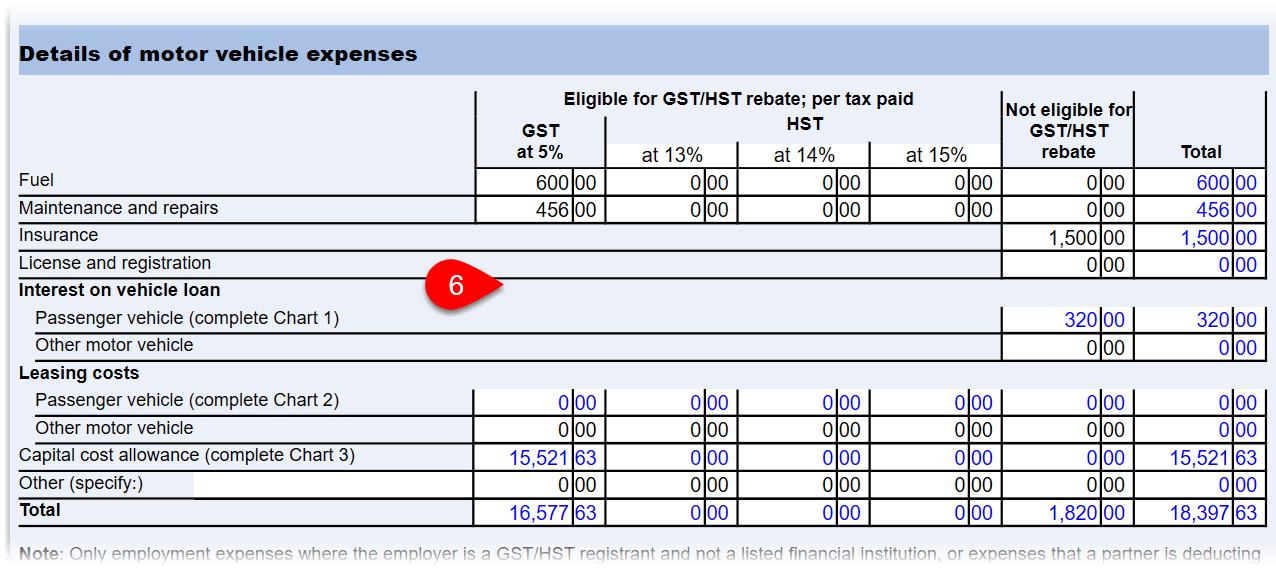

Motor Vehicle Expenses Taxcycle

Motor Vehicle Expenses Taxcycle

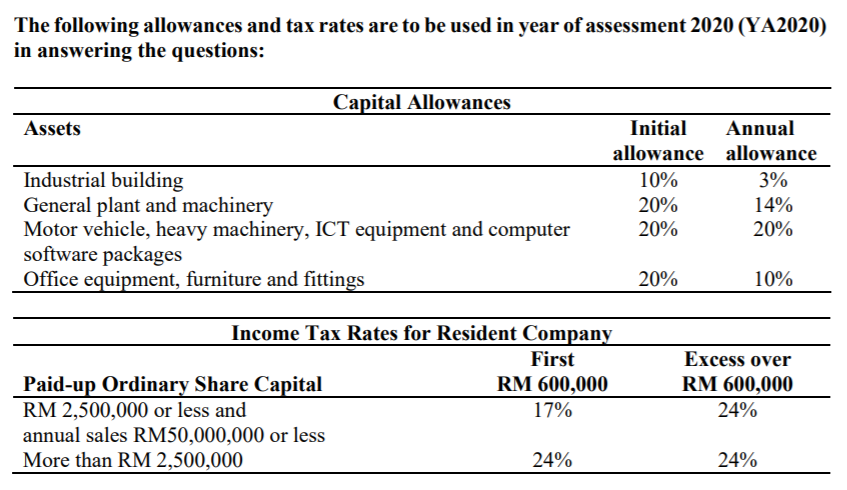

Solved Annual Allowance 20 14 40 10 Type Of Asset Chegg Com

Compare Car Iisurance Compare Auto Lease Vs Purchase Car Lease Compare Cars Lease

Tax Implications Of Financial Arrangements For Motor Vehicles Acca Global

Solved The Following Is The Information Regarding Maya Enterprise Compute The Amount Of Capital Allowance Balancing Allowance Or Balancing Charge Course Hero

Knowledge Bureau World Class Financial Education

Business Vehicle Expenses Focus On Tax

Motor Vehicle Expenses Taxcycle

Solved Annual Allowance 20 14 40 10 Type Of Asset Chegg Com

Preparing The Capital Allowance Computation Non Pool Assets Acca Taxation Tx Uk Youtube

Motor Vehicle Expenses Taxcycle

Capital Cost Allowance Cca Classes And Rates Corporate Taxation

The Following Allowances And Tax Rates Are To Be Used Chegg Com